Location Lorem Ipsum

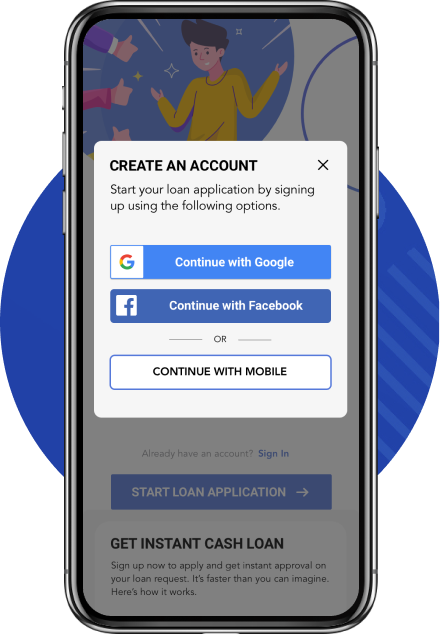

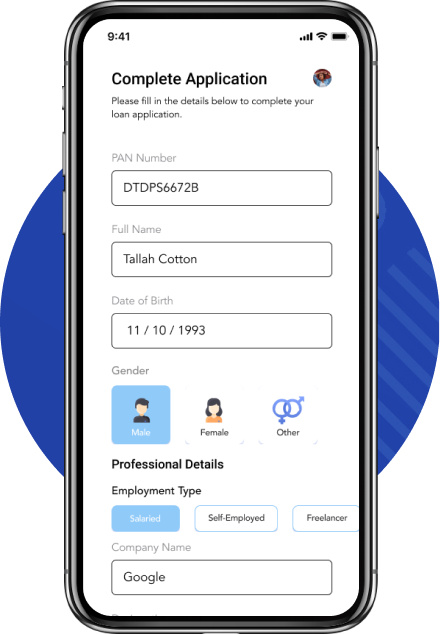

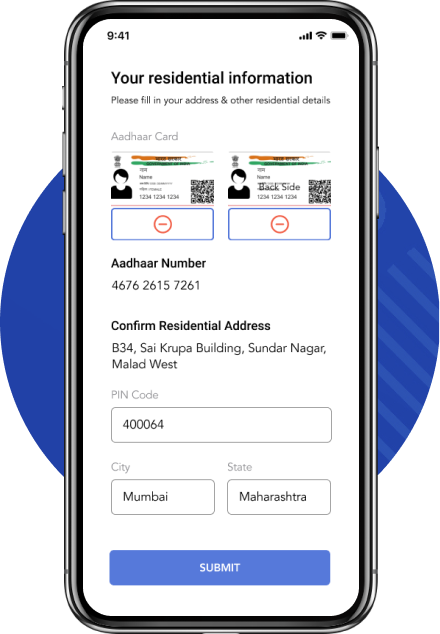

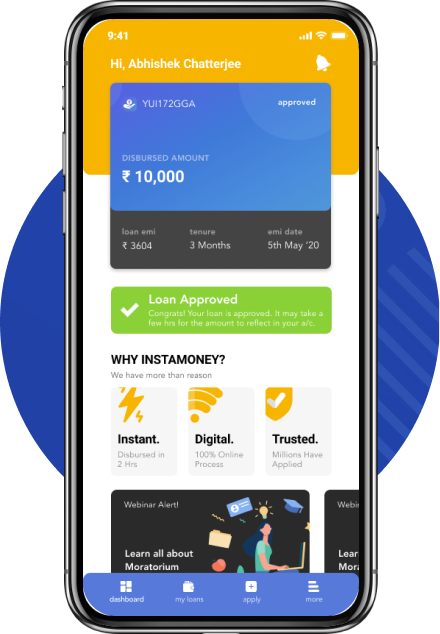

We have always worked towards creating a product that helps solve the problem of complicated borrowing in India by not just catering to a larger audience but also by adapting it to the new age and making the entire process quick and digital.