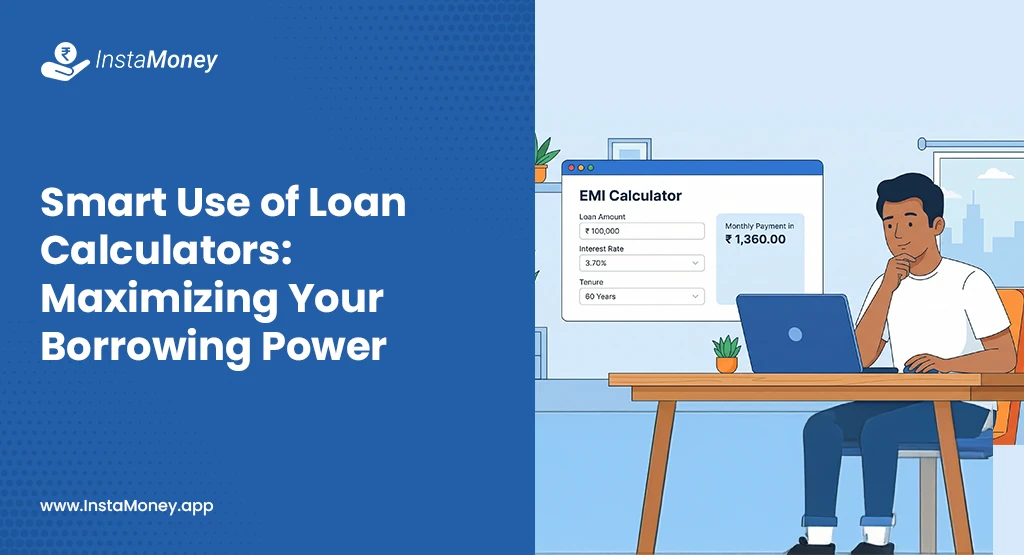

When you are thinking about borrowing money, confusion often creeps in fast. How much should you actually borrow? What will your monthly payments look like? How long should your loan last? A loan calculator helps you to get rid of these questions and gives you real numbers to work with.

You can use InstaMoney loan calculator that works for almost all types of loans. What you need to do is just provide your loan amount, annual interest rate, and tenure. Calculator will give you the exact EMI you need to pay monthly along with total interest amount.

Loan calculators have become essential for anyone considering a personal loan. It helps you make decisions with confidence, not guesswork.

Whether you need emergency cash or funds for a special purchase, knowing exactly what you’re getting into matters.

Why Loan Calculators Matter More Than You Think?

A loan calculator does more than just math. It’s your personal finance advisor that works 24/7. Most people don’t realize they’re overpaying on loans because they never saw the full picture upfront.

When you use a calculator, you suddenly see how different loan amounts and tenures affect your pockets.

Let’s say you need ₹20,000 for an unexpected expense. A calculator shows you that borrowing this amount over 6 months costs less in interest than spreading it over 12 months, but your monthly payment is higher. Over 12 months, your payment is smaller but you pay more total interest. This comparison helps you choose what fits your budget best.

The biggest mistake people make is borrowing more than they need. A calculator shows you the real cost of that extra money. If you borrow ₹25,000 instead of ₹20,000, how much more interest do you pay? The answer might shock you into borrowing only what you actually need.

Your tenure matters just as much. Shorter tenures mean higher monthly payments but lower total interest. Longer tenures spread payments out but cost you more overall. A calculator lets you find your sweet spot, not based on what you want to pay, but on what makes financial sense for your situation.

Taking Action With Your Calculator Results

Once your calculator shows you the numbers, write them down. Compare at least 2-3 different scenarios. Then look at your actual monthly budget. Can you comfortably afford the payment? Will you still have money left for emergencies and other needs?

Use your calculator insights to fill out your application confidently. You already know what you can afford. You’ve done the homework. Now let a reliable loan app handle the rest. Start your application today and turn those calculator numbers into real financial help.