Money a paramount significance for viability, especially, during the pandemic where the world is hit by COVID-19, and the global economy is struck. It’s crucial to have a monthly expense budget for our needs and wants. But in these evil times, where you need urgent cash because of unpaid leaves, cut-offs in salaries and layoffs are spiking in numbers and moreover, it is extremely difficult to stay loyal to the expenses.

In such a situation, where expenses are on the verge of hitting the limit and you’re suddenly in need of some urgent cash? That urgent cash may be for any reason, it could be to pay your monthly bills. Or you could find yourself in the middle of a medical emergency when you least expect it but your credit card is already maxed out.

But,you need not worry, sitting in the comfort of your home, you can apply for instant

personal loans online to meet all your urgent cash requirements.

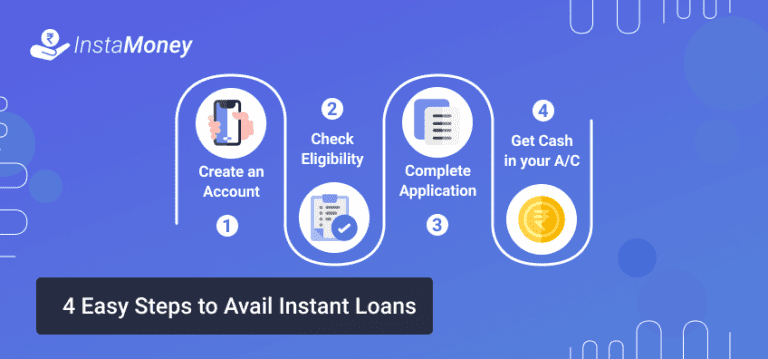

With P2P Lending, you can get fast personal loans online in the easiest way possible at the lowest interest rates. With InstaMoney, an app created exclusively for borrowers like you; the convenience goes a step further – you can get a personal loan instantly on your mobile, with just a few clicks.

InstaMoney is an instant short-term cash loan product for salaried individuals, looking for very short duration loans to fulfill their need of shopping, consumer durable purchase, down payment for a bike which they want to repay within 30-90 days. The loan amount that we’ll be offering under the product category is between Rs. 5000 & Rs. 10000 for a tenure of 1 to 3 months. Usually, approvals are given within 24 hours if we receive your complete application.

You can borrow money for a wedding, for a medical emergency, for your home renovation, to pay off your credit card dues or for an advance salary loan.

So why worry about your liquidity crunch!! When you can apply for a quick cash loan and throw your worries away.

Click here to download InstaMoney app now!