Credit scores are not merely points but an indicator to something deeper. They give financial institutions an idea about your credibility as a person. Low credit scores are an indication that you’re not good with repayments and financial institutions will think twice before giving you another loan. A good credit score not only shows you’re credible but also keeps you in a position of strength when applying for a fresh low. But many a times situations come up, blocking us from paying the EMI’s on time which reflects badly on the credit score. But there’s always a way out. Here’s the things you need to do to get back on the good books of the financial institutions and improve your credit score:

1. Pay off your credit card bills in full:

Credit cards are a big thorn in your way if you’re looking to improve your credit score. Try keeping up with your EMI dates and make multiple payments in the same month if possible. If you have more than one credit card, consolidate the bill entirely through an instant short term Personal loan from a bank or Peer to Peer lending platform like LenDenClub. This is a viable way out as it’s hard to remember multiple dates and the interest rates are too damn high. P2P loans are structured for specifically this purpose, among others.

2. Increase your savings:

If you’re really serious about improving your credit score, take extreme measures. Start spending less on luxuries and stop buying things for a while. This way you’ll save valuable amounts each month which could be used to pay off the EMI or credit card bills for the next month in advance. Be smart with your spending and look out for discounts and coupons. This will be reflected in your credit report which will show your good intention towards repayment.

3. Do not indulge in settlements:

Settlements should be your last retort when on the quest to improving your credit score. Settlements reflect bad behaviour towards repayments and gives the financial institutions a subconscious message that you’re not interested in paying the due, even if you are. Pay the whole amount due in one go. Alternatively, you could pay half or quarter of the due amount and pay the rest as and when you get the cash. There’s a provision whereby you can sit down with your financier and work out how you’re going to pay the outstanding amount. This reflects responsible behaviour on the part of the borrower and shoots your credit score up.

4. Take out high interest rate loans:

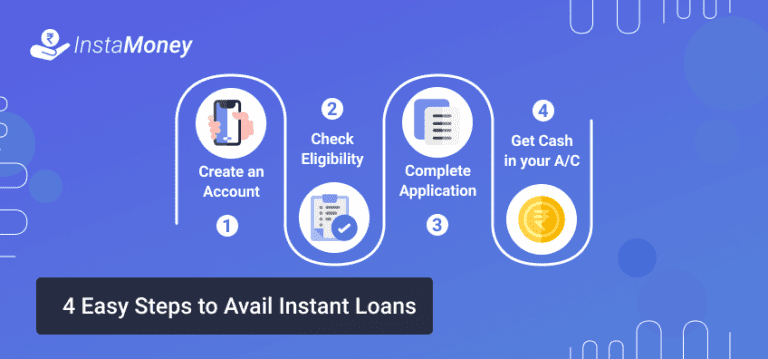

Here’s the quickest way out. It may sound a bit uncanny but taking out a high interest rate instant personal loan could work wonders when improving your credit score. The Credit Bureau too would take this into account and conclude that you’ll be able to pull of lower interest rate loans too. Your past blip in your credit score suddenly gets overshadowed by the enormity of the interest rate you’re paying. But this should be an option if you have a high paying day job to be able to pay the expensive EMI of this personal loan. If you’re able to pull this off, your credit score will reflect a significant rise and suddenly you’ll be getting calls everyday from various financial institutions offering you loans.

Peer-to-Peer lending platforms like LenDenClub would be ideal in such a scenario as they offer instant, short term personal loans to individuals whose applications are rejected outright by banks on account of low credit scores. Money lenders like LenDenClub offer same day approval and disburse the money within 72 hours. Salaried employees having a pay below 20,000 are not rejected like they are by banks, in fact the salary cap at LenDenClub is as low as 12,000. For honest, loyal individuals not looking to debunk on EMI payments and in need of inspiration for improving their credit scores, P2P loans fit the billing. Apply now and improve your credit score.